FHA Home Loans: Easy Steps to Secure Your Desire Home

FHA Home Loans: Easy Steps to Secure Your Desire Home

Blog Article

Navigating the Home Lending Landscape: Key Aspects to Think About When Selecting the Right Funding Program for Your Requirements

Browsing the home loan landscape is an important procedure that requires an extensive understanding of numerous factors influencing your decision. It is necessary to set apart between car loan kinds, such as adjustable-rate and fixed-rate home mortgages, while also assessing rate of interest prices and terms that might influence your economic future.

Comprehending Funding Types

Recognizing the various kinds of home fundings is important for making an educated monetary choice. Home finances normally fall under numerous groups, each made to deal with details borrower demands and monetary situations.

Fixed-rate home loans are amongst the most typical lending kinds, supplying borrowers a stable rate of interest and predictable month-to-month repayments over the life of the car loan. This security makes them an enticing alternative for those who prepare to remain in their homes long-lasting. Conversely, adjustable-rate home mortgages (ARMs) feature variable rate of interest rates that can change after a preliminary fixed period, potentially bring about lower preliminary settlements however boosted future prices.

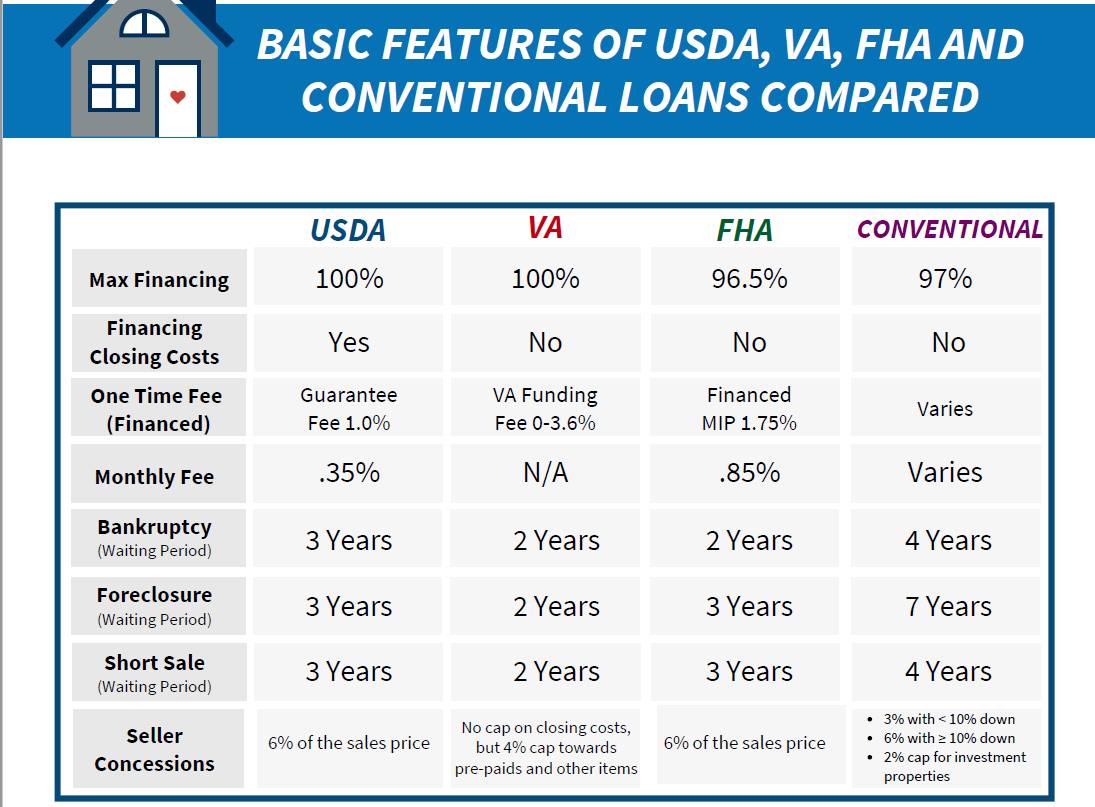

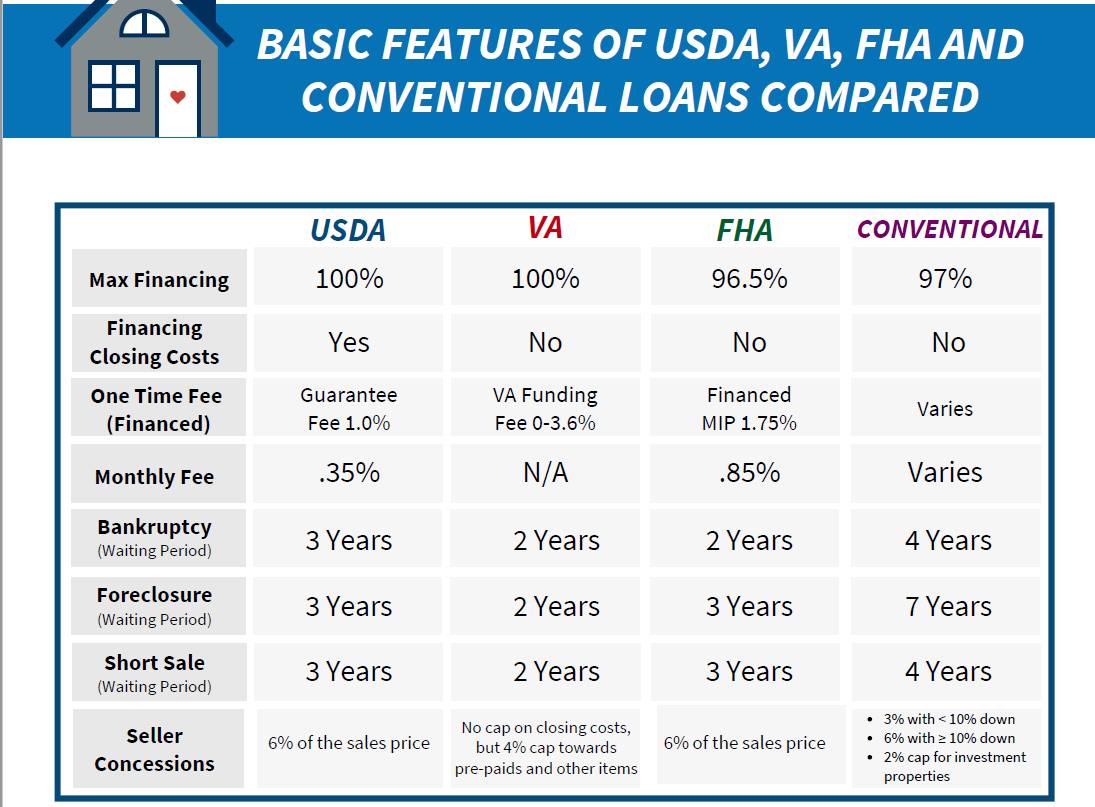

One more noteworthy choice is the government-backed car loan, such as FHA, VA, or USDA finances, which give desirable terms for qualifying customers. These finances can be especially beneficial for first-time buyers or those with limited credit report.

Examining Rates Of Interest

When comparing mortgage, it's important to weigh the interest rates provided by different loan providers. Rate of interest straight affect your month-to-month payments and the general expense of your home loan, making it an essential consider your decision-making process. A reduced passion rate can substantially minimize your financial concern, while a greater price may lead to unneeded expenditures over the car loan's term.

It is vital to comprehend the distinction between set and variable rates of interest. Dealt with rates stay the same throughout of the funding, providing stability and predictability in budgeting. On the other hand, variable prices can rise and fall based upon market conditions, which may lead to lower preliminary repayments however could boost in time.

Additionally, take into consideration the Yearly Percentage Price (APR), that includes both the rates of interest and any kind of affiliated fees, offering an extra detailed picture of the funding's price. Always compare prices from numerous loan providers and ask about any kind of promotional offers that might use. Bear in mind, even a mild difference in rate of interest can bring about considerable savings over the life of the financing, making complete analysis important in picking the most helpful home lending for your monetary scenario.

Evaluating Financing Terms

Clearness in financing terms is essential for making a notified choice about your home loan. Recognizing the specifics of lending terms equips borrowers to assess their choices properly and select a program that aligns with their monetary objectives. Trick elements to consider include the period of the financing, which generally varies from 15 to three decades, affecting monthly repayments and overall rate of interest paid over the life of the financing.

Another crucial element is the amortization timetable, which lays out how much of each payment goes check this toward primary versus rate of interest. A much shorter amortization duration normally suggests greater month-to-month settlements yet less total rate of interest, while a longer duration might supply reduced settlements at the cost of raised interest gradually.

Additionally, borrowers must examine any kind of early repayment charges, which could affect adaptability if they determine to pay off the loan early. Recognizing whether the lending is taken care of or flexible is also vital, as this determines how rate of interest will alter in time. Clear comprehension of these elements is vital for browsing the intricacies of lending programs, inevitably bring about an extra enjoyable and economically audio home mortgage option.

Evaluating Your Financial Scenario

A comprehensive analysis of your economic circumstance is essential before devoting to a mortgage. Recognizing your income, financial savings, costs, and financial debts provides a clear photo of your loaning ability and the kind of loan that lines up with your financial goals. Start by evaluating your monthly earnings, including wages, bonus offers, and any type of extra sources (FHA home loans). Next, information your monthly expenses, ensuring to represent needs such as utilities, groceries, and transportation.

In addition, examine your current financial debt responsibilities, including credit report card balances, pupil loans, and existing home mortgages. This information will certainly help establish your debt-to-income ratio, a crucial variable loan providers consider when reviewing your car loan application. A reduced ratio signifies a much healthier financial scenario and enhances your chances of safeguarding beneficial financing terms.

Thinking About Future Strategies

Considering your future strategies is a vital action in the home funding process, as it affects the sort of home loan that ideal matches your demands. over at this website Whether you anticipate broadening your family members, relocating for profession possibilities, or preparing for retirement, these elements will certainly lead your decision-making.

If you foresee a change in family size or way of life, you might wish to consider a funding that enables adaptability, such as a variable-rate mortgage (ARM) or a longer term. This offers the chance to offer or re-finance without incurring considerable charges. On the other hand, if you intend to stay in your house for a prolonged duration, a fixed-rate home loan may provide stability and predictability in your regular monthly repayments.

Involving with a home loan expert can aid you analyze exactly how your future plans align with existing finance choices, ensuring that you pick a program that not only fulfills your instant needs yet likewise supports your long-lasting goals. Inevitably, a knowledgeable choice today can pave the way for a secure financial future.

Final Thought

To conclude, selecting the suitable mortgage program demands a detailed evaluation of various aspects, including loan kinds, interest prices, and loan terms (FHA home loans). A thorough assessment of one's financial circumstance, together with factors to consider of future strategies, is important in making an informed decision. By carefully assessing these aspects, individuals can align their mortgage choices with their long-term goals and monetary objectives, inevitably facilitating a much more safe and beneficial homeownership experience

Fixed-rate home mortgages are Continued amongst the most usual lending types, using consumers a secure interest rate and predictable monthly payments over the life of the car loan. Keep in mind, even a mild distinction in passion prices can lead to significant financial savings over the life of the car loan, making complete examination crucial in picking the most useful home financing for your economic scenario.

Trick aspects to think about include the duration of the loan, which typically ranges from 15 to 30 years, affecting month-to-month settlements and complete rate of interest paid over the life of the funding. (FHA home loans)

A robust financial structure not just enhances your lending qualification yet likewise settings you for long-term economic stability in homeownership.

In conclusion, selecting the ideal home finance program demands an extensive assessment of numerous aspects, including lending kinds, rate of interest rates, and finance terms.

Report this page